Order Credit Report

Oct 19, 2023 By Triston Martin

For free from www.annualcreditreport.com. Federal law gives you one FREE copy of your Experian credit report every year. You can also get an annually Experian credit file by calling 1-877-322-828 or sending the request form. You can check online your Experian credit report at CreditKarma.com. It's a completely free service that doesn't require the purchase of a credit card or the need for a trial period.

You can buy an Experian credit file and your FICO scores from Experian with the Transunion and Equifax scores for a single payment cost of $39.99 and receive an update every day on your credit report and score. You can also sign up for updates every month for free. If you choose to join the trial, be sure you cancel your subscription within seven days of when the trial expires to avoid paying on the subscription. If you buy three-in-one credit reports from any online sellers, you'll get your Experian credit report and a report from the two other big credit bureaus, Equifax and TransUnion.

Dispute Errors

You may discover the error on your Experian credit report after you receive it. The Fair Credit Reporting Act may give the consumer the right to have these mistakes removed by the dispute procedure. The credit report you receive will usually include instructions on how to dispute the errors. If you purchase an Experian credit report on the internet, you'll receive the option to use it to file a complaint. You may also contest the errors on your credit report in writing.

Make a credit report dispute letter, highlighting the mistakes on your credit report, and submit any documents supporting your claim to Experian's credit reporting dispute address the best way to send your dispute letter to Experian is using certified mail, so you know when the letter was delivered. When Experian has received your complaint, it will have 30 days to look into and rectify your credit report or provide the results of its investigation.

Fight Identity Theft On Reports

If you've fallen victim to theft of your identity, it's crucial to let Experian inform them so that they may alert your credit report and notify the two other credit bureaus. An alert for fraud lets anyone who checks the Experian credit report know they must take additional steps to verify their identity. The fraud alerts are valid for one year.

You can put an alert about fraud in the Experian credit report online, by phone by calling 1-888-397-342. An Experian secure freeze on your credit reports will block your credit report, stopping requests until you can unlock it by an account number or password. Contact Experian, or visit their website for more instructions on freezing your credit file.

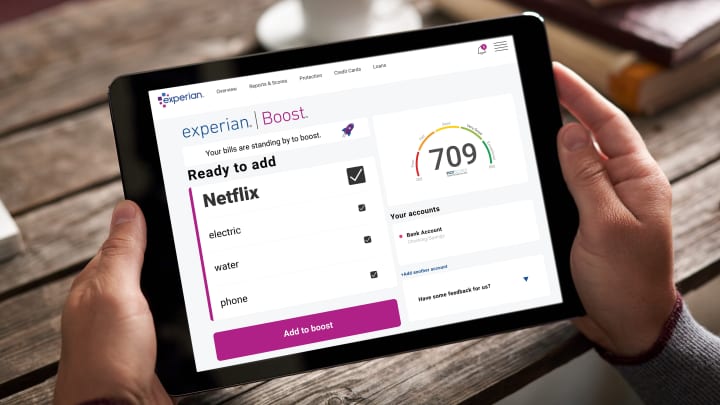

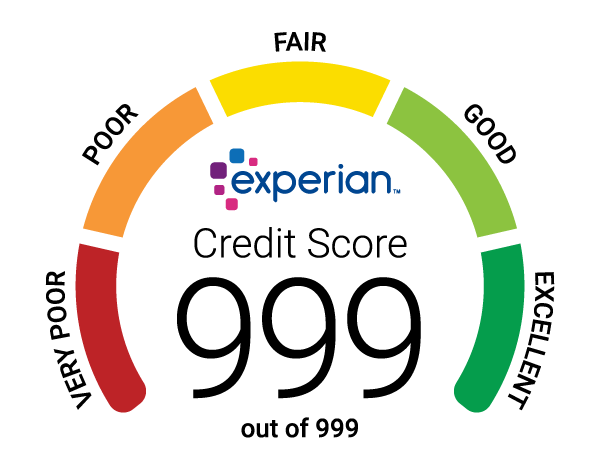

Checking Your Score

Your Experian credit score is derived from the information in your Experian credit report, which determines your creditworthiness. It may differ from the credit ratings you get from the other two agencies. You don't have to pay anything to check your Experian credit score when using CreditKarma.com. You may also get your Experian credit score from the website of Experian or through the website of myFICO.com.

How Often Is My Credit Report Updated?

Creditors generally forward data to credit bureaus every month. But, there is no specific date when lenders change their information. Therefore, a credit bureau might be updated by one of the lenders on the 1st of each month and from an additional lender around the 15th day of each month. Therefore, your credit reports may differ daily based on when your creditors provide a batch of loan and payment history information to the credit bureaus.

What if I Find a Mistake in My Credit Report?

If you do not plan to seek credit, it’s an excellent idea to review your credit score from every bureau regularly. Ensure that the information you provide for identification is accurate and that the credit accounts on your report are accurate. If you plan to make an application for a new credit card or loan, it is essential to examine your credit reports before applying to determine if there's anything that needs to be cleared up. Any negative information on your credit report can affect your credit scores. You would like your credit score to remain the most favorable before applying for new credit.

According to the Federal Credit Reporting Act, the credit bureau and the information service provider (such as lenders that provided you with information for the credit bureau) are responsible for rectifying any inaccuracy or incorrect data in your reports. For corrections to the information, initiating an appeal to the agency that handles your credit report is necessary. It is usually done by submitting your complaint in writing. The credit reporting company must examine any dispute you have within 30 days after receiving your request.