Connecting Borrowers and Lenders through Loan Aggregators

Oct 02, 2024 By Vicky Louisa

In the area of personal and business money management, searching for a suitable loan can many times be challenging. There are many lenders and different types of loans present, therefore borrowers may find it tough to locate options that match their distinct requirements. Loan aggregators come up as important middlemen in this field, helping establish links between those who need a loan and those who grant them while making selecting the right loan simpler. This article is going to inspect the role of loan aggregator services, their advantages, what process they use, and how these affect financial scenery.

Understanding Loan Aggregators

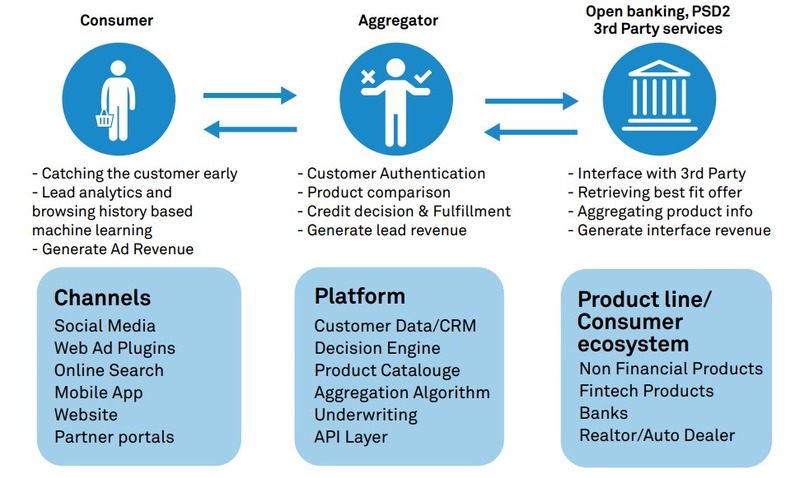

Platforms known as loan aggregators, gather and arrange various loan offers from many lenders in a single place. These are online services that help borrowers contrast different types of loans like personal ones, mortgages, or business loans. Loan aggregators use algorithms and data analysis effectively to link borrowers with suitable lenders according to the financial profiles and preferences of the borrower. This method assists in making the loan application procedure more efficient and enhances the possibility of receiving desirable terms for loans.

- Variety: Loan aggregators typically partner with a wide range of lenders, including traditional banks, credit unions, and online lenders, ensuring diverse options for borrowers.

- Consumer Education: Many aggregators offer articles, guides, and FAQs that can help borrowers better understand loan products and financial concepts.

Benefits of Using Loan Aggregators

A main benefit of using loan aggregators is the time and effort that borrowers can save. Borrowers don't have to check different lenders and their offers on their own, they can see many options in one place instead. This makes choosing a loan faster, as well it gives them competitive rates and conditions. Also, loan groupers typically offer instruments and materials, like loan computers and instructive content, to assist borrowers in making knowledgeable choices.

One big advantage is the increased clearness that loan aggregators give. They showcase many offers at once so borrowers can compare interest rates, payment terms, and extra charges easily. This kind of clarity helps borrowers to select loan services that match their money-related aims. Also, a lot of loan collectors give customized suggestions according to the borrower's credit history, increasing the chances for approval.

- Simplicity: The user-friendly interfaces of loan aggregators allow borrowers to navigate options easily, making the process less overwhelming.

- Competitive Offers: Aggregators may negotiate with lenders to secure exclusive deals or lower rates that are not available directly through lenders.

The Loan Aggregation Process

Usually, when you want to use a loan aggregator, the first thing is for you to complete an online form. You need to give simple personal and financial details like how much money you get paid if you have work and your credit rating. After they receive your request form with these data points filled in by yourself, what the loan aggregator does next is examine this information which has been given by yourselves. They then pair it up against different lending institutions within their pool of contacts based on what those lenders offer.

After the application has been processed, the aggregator provides the borrower with a list of possible loan choices. This enables them to examine conditions and pick out the most appropriate one. Once they make their selection, it's up to the aggregator to make sure there is good communication between the lender and borrower to finish off everything involved in applying for this loan. The goal of using this kind of method is less about paperwork or having issues communicating and more focused on making things easier overall for users when getting loans.

- Timeframe: Borrowers can often receive loan offers within minutes of submitting their application, significantly speeding up the financing process.

- Multiple Submissions: Using an aggregator can help borrowers avoid submitting multiple applications to various lenders, which can negatively impact their credit score.

Loan Aggregators and Financial Matchmaking

The idea of aligning financial needs has become popular in the last few years. More and more people who need to borrow are looking for custom-made answers fitted to their money matters. This idea is put into practice by loan aggregators, they give specific borrowing suggestions according to each person's profile. They study different things like past credit behavior and what a borrower requires from a loan, then point out lenders that may offer good conditions.

This part of uniting borrowers and lenders, not only makes the borrowers happy but also helps lenders to find the right clients in a better way. Lenders benefit from getting leads that are already selected carefully, so they have more chances to convert these into deals. In this manner, loan aggregators become very important for making lending procedures good for both sides involved.

- Market Trends: Understanding current market trends can help borrowers recognize which loan types are most favorable in changing economic climates.

- Long-Term Relationships: Aggregators can help establish ongoing relationships between borrowers and lenders, facilitating future loan opportunities.

Challenges and Considerations

Although loan aggregators present many advantages, people who are thinking about borrowing should stay conscious of particular issues that come with using these platforms. One problem to be careful of is the changeable quality among different aggregators' services. It's not guaranteed that all loan aggregators have similar connections to lenders or give equal types of loans. So, it is important for those who want to borrow money to do a thorough check. This will help them find good aggregators that satisfy their requirements.

Furthermore, it's important for people borrowing money to be careful when they share their personal and financial details. They must look at the privacy rules and how data is protected by those who bring together different loan offers to keep individual information safe. It's key to know how this info will be used and kept as part of keeping things secure during times when loans are applied for.

- Research Requirements: It's vital to research and read reviews about various aggregators to choose a trustworthy service.

- Beware of Fees: Some aggregators may charge fees for their services, so its essential to clarify any costs involved before proceeding.

The Future of Loan Aggregators in Finance

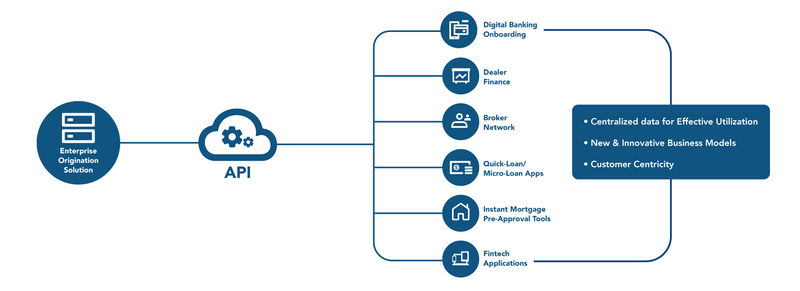

As technology keeps growing, the part of loan aggregators will probably grow and adjust to the changing financial surroundings. The incorporation of artificial thinking ability and machine education could improve the matching procedure, making it more exact and faster. Consequently, those who borrow might gain from progressively customized loan proposals that go well with their financial situations closely.

Additionally, with the rising need for digital solutions, more loan takers might consider loan aggregators as a main source to get financing. This change could result in higher competition among loan providers and better loan offerings for customers. In the end, the outlook of loan aggregators seems hopeful because they keep changing how borrowers link up with lenders and handle difficult aspects of getting loans.

- Emerging Technologies: Technologies such as blockchain may provide more secure and efficient ways to process loans through aggregators.

- Regulatory Changes: Future regulations could impact how aggregators operate, potentially enhancing consumer protections and transparency in the lending process.

Conclusion

To sum up, loan aggregators play a key role as helpers in the financial linking process. They connect people who want to borrow with those who lend money in an effective and easy-to-use way. By smoothing out the application for loan procedure plus giving useful resources, these platforms enable borrowers to choose wisely about their finances. With changes happening within our economic environment, we can expect that loan aggregators will become even more important, bringing benefits not only for borrowers but also for lenders.